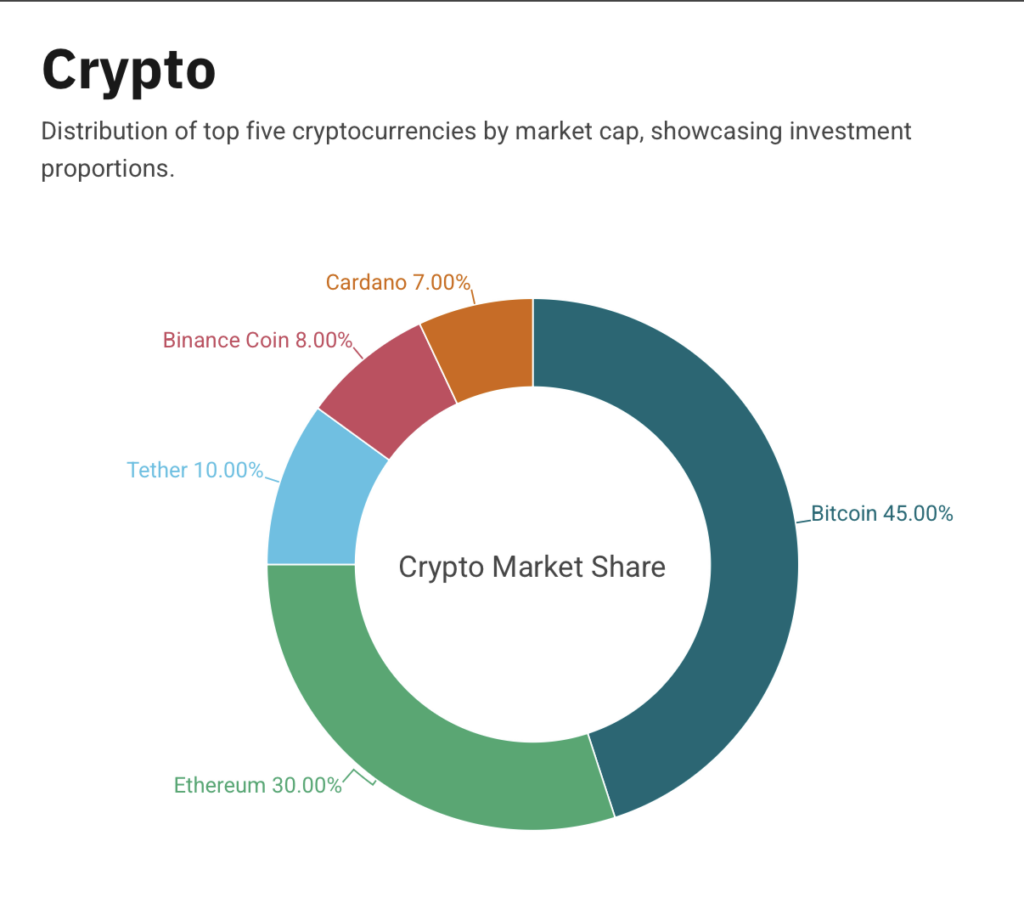

The world of cryptocurrency is ever-evolving, with new projects emerging regularly and market dynamics changing almost daily. However, when we talk about the top cryptocurrencies, we are often referring to the ones with the largest market capitalization, as these coins represent a significant portion of the entire market. Market cap is a simple calculation: it is the price of the cryptocurrency multiplied by the circulating supply of the coin. Market cap is one of the best ways to gauge the size and influence of a cryptocurrency in the market.

As of 2025, the top five cryptocurrencies by market capitalization reflect the continued dominance of familiar names, though new technologies and innovations are always on the horizon. Let’s dive into these top five cryptocurrencies and explore why they continue to dominate the market.

1. Bitcoin (BTC) – The Pioneer and Market Leader

Market Cap: ~$1 Trillion (approx.)

Bitcoin (BTC) has been the undisputed leader in the cryptocurrency market since its creation in 2008 by the anonymous figure Satoshi Nakamoto. As the first decentralized cryptocurrency, Bitcoin paved the way for the entire digital currency ecosystem. It remains the largest cryptocurrency by market capitalization, with a market cap that consistently hovers around $1 trillion.

Why Bitcoin Continues to Lead:

- Store of Value: Bitcoin is often referred to as “digital gold” because it shares several characteristics with gold. It has a fixed supply of 21 million coins, making it resistant to inflationary pressures. Over time, Bitcoin has gained a reputation as a store of value, especially in times of economic uncertainty.

- Institutional Adoption: Over the years, Bitcoin has gained substantial institutional interest. Large corporations, hedge funds, and even countries have begun to incorporate Bitcoin into their portfolios, cementing its place in mainstream financial markets.

- Security and Trust: Bitcoin’s proof-of-work consensus mechanism is considered one of the most secure in the crypto space. Its established network, high liquidity, and historical performance make it a reliable asset for investors.

Despite facing criticism for its energy consumption and scalability issues, Bitcoin continues to be the benchmark for the cryptocurrency market. Its reputation as a safe and stable investment, along with its ongoing network upgrades like the Lightning Network, ensures that it remains the top choice for both retail and institutional investors.

2. Ethereum (ETH) – The Smart Contract Pioneer

Market Cap: ~$600 Billion (approx.)

Ethereum, created by Vitalik Buterin and others in 2015, is the second-largest cryptocurrency by market cap. It is best known for its innovative smart contract functionality, which allows developers to build decentralized applications (dApps) on its platform. Ethereum has become the backbone for many decentralized finance (DeFi) projects and non-fungible tokens (NFTs), making it a crucial player in the evolving Web3 ecosystem.

Why Ethereum is So Important:

- Smart Contracts and dApps: Ethereum’s ability to execute smart contracts is what sets it apart from Bitcoin and other cryptocurrencies. Smart contracts are self-executing contracts with the terms of the agreement directly written into code. This functionality has allowed Ethereum to become the dominant platform for decentralized applications and has led to the explosion of DeFi and NFTs.

- Ethereum 2.0 Upgrade: One of Ethereum’s most significant challenges has been its scalability. Ethereum 2.0, a major upgrade to the Ethereum network, has been rolling out since 2020. The transition from proof-of-work to proof-of-stake aims to make the network faster, more scalable, and less energy-intensive, addressing many of the concerns that have held back Ethereum’s potential.

- Vibrant Ecosystem: Ethereum’s robust ecosystem is a key reason it remains so popular. With thousands of dApps, DeFi protocols, and NFT marketplaces built on its blockchain, Ethereum has solidified its position as the go-to platform for decentralized finance and digital assets.

Ethereum’s adaptability and ongoing upgrades make it a strong contender for continued dominance in the cryptocurrency space. The Ethereum network is not only a financial tool but also an enabler of a new decentralized internet, known as Web3.

3. Tether (USDT) – The Leading Stablecoin

Market Cap: ~$80 Billion (approx.)

While not a typical cryptocurrency, Tether (USDT) holds a significant position in the top five by market capitalization. Tether is a stablecoin, meaning its value is pegged to a reserve asset, such as the U.S. dollar, to maintain a stable value. Unlike Bitcoin or Ethereum, which can be highly volatile, USDT’s value remains relatively stable, making it a popular choice for traders and investors who want to avoid price fluctuations.

Why Tether is So Popular:

- Price Stability: The primary purpose of Tether is to provide a stable store of value that is less susceptible to market fluctuations. This stability makes it an ideal medium of exchange within the crypto space, especially for traders looking to park profits or mitigate risks.

- Liquidity and Usage: USDT is the most widely used stablecoin and is frequently used for trading on crypto exchanges. Many investors use it as a safe-haven asset when they want to move in and out of volatile cryptocurrencies without converting to fiat currency.

- Global Reach: Tether’s stability and ease of use have made it popular in both emerging and developed markets. It is widely accepted across numerous exchanges and used for various purposes, from trading to remittances.

Despite controversies around the transparency of its reserves, Tether continues to be a crucial part of the crypto ecosystem. It enables fast, low-cost transactions across borders, and its liquidity ensures that it remains a staple in the market.

4. Binance Coin (BNB) – The Exchange Token

Market Cap: ~$80 Billion (approx.)

Binance Coin (BNB) is the native cryptocurrency of the Binance exchange, the largest cryptocurrency exchange in the world by trading volume. Originally launched as an ERC-20 token on the Ethereum network, BNB later migrated to its own blockchain, Binance Chain. Over the years, Binance Coin has evolved from a utility token used for discounted trading fees to a multifaceted asset with various use cases.

Why Binance Coin is Valuable:

- Utility on Binance Platform: BNB is primarily used to pay for trading fees on the Binance platform, providing users with a discount when using the token. This makes BNB essential for anyone who trades regularly on the exchange.

- Binance Smart Chain (BSC): Binance Coin is also integral to the Binance Smart Chain (BSC), a blockchain that supports decentralized applications and smart contracts. BSC has gained significant traction as a faster and more affordable alternative to Ethereum, and BNB is used to pay for transaction fees on the network.

- Deflationary Model: Binance has a deflationary model for BNB, periodically burning (destroying) tokens to reduce the total supply. This helps maintain scarcity, potentially increasing the value of the coin over time.

BNB’s role in the Binance ecosystem and the growth of Binance Smart Chain have helped it maintain a strong position in the market. Its utility and continued adoption ensure its place in the top five cryptocurrencies.

5. USD Coin (USDC) – Another Leading Stablecoin

Market Cap: ~$50 Billion (approx.)

USD Coin (USDC) is another popular stablecoin that is pegged to the U.S. dollar. It was launched by Circle and Coinbase as part of the Centre Consortium. Like Tether, USDC is used primarily as a stable store of value and a medium of exchange within the cryptocurrency market.

Why USD Coin is Popular:

- Regulated and Transparent: USDC is fully backed by fiat reserves, and its reserves are audited regularly to ensure full transparency. This regulatory compliance has earned it a level of trust that is appealing to both retail and institutional investors.

- Use in DeFi: USDC is widely used in decentralized finance applications, providing liquidity to DeFi protocols and serving as a stable asset for yield farming, lending, and borrowing.

- Cross-Border Payments: Like Tether, USDC is widely used for remittances and cross-border transactions, offering a faster, cheaper alternative to traditional banking systems.

USDC has become a top contender among stablecoins due to its regulatory compliance and transparency. It provides an alternative to Tether with a similar use case but with a reputation for greater oversight.

As of 2025, Bitcoin, Ethereum, Tether, Binance Coin, and USD Coin remain the dominant players in the cryptocurrency market, each serving distinct purposes and offering unique advantages. Bitcoin continues to be the leading store of value and a safe haven for investors, while Ethereum remains the go-to platform for decentralized applications. Stablecoins like Tether and USD Coin offer stability in an otherwise volatile market, and Binance Coin thrives as the utility token of one of the largest exchanges in the world.

The cryptocurrency landscape is constantly evolving, but these top five cryptocurrencies show no signs of losing their relevance. Whether you’re a seasoned investor or a newcomer to the crypto world, these digital assets represent the foundation of the industry and will likely continue to shape the future of finance.